The world of banking is evolving at a blistering pace.  Digitisation and challenges from FinTechs require even the most traditional banks to move with the times . It’s no wonder banks are feeling nervous: the rise of FinTechs and challenger banks have chipped away at market share by disrupting the way people bank with a focus on simplicity and value. Banks are responding to the needs of smartphone-savvy younger people by developing their digital services and closing branches: but apps cannot dispense financial advice. There is still a need for human, often face-to-face contact, particularly for older customers.

Digitisation and challenges from FinTechs require even the most traditional banks to move with the times . It’s no wonder banks are feeling nervous: the rise of FinTechs and challenger banks have chipped away at market share by disrupting the way people bank with a focus on simplicity and value. Banks are responding to the needs of smartphone-savvy younger people by developing their digital services and closing branches: but apps cannot dispense financial advice. There is still a need for human, often face-to-face contact, particularly for older customers.

Plus, what once was viewed as loyalty has been revealed to be inertia: most banking customers fail to close accounts they no longer see value in simply to avoid life admin, whilst purchasing new products elsewhere. This shows how banks struggle to cross-sell, meaning they must find a balance between efforts to retain and acquire customers, particularly those attracted by offers of a seamless and personalised digital experience.

Indeed, this fractured approach to financial management may not feel too different for current customers of big banks. Complex customer journeys across touchpoints managed by different business silos, mean that interactions with them can already be convoluted. Compare this with the simplicity and convenience of a Monzo app, and the difference is starkly apparent.

Banks must simplify and digitise to keep up with people’s needs, but they must also revisit their role in specific moments of their customers’ lives to guard against challenges from competitors. A seamless, customer-centric approach with great products is nothing unless it is based on meaningful moments of interaction. The opportunity for banks is huge: in an age of big data, arguably, no one should know their customers as well as a bank. Access to spending habits should tell them volumes about who we are and what support or products we may need. The hot house of intense competition looks set to create some of the most interesting innovation to date. What does this look like for a sector in flux?

Banks must simplify and digitise to keep up with people’s needs, but they must also revisit their role in specific moments of their customers’ lives to guard against challenges from competitors. A seamless, customer-centric approach with great products is nothing unless it is based on meaningful moments of interaction. The opportunity for banks is huge: in an age of big data, arguably, no one should know their customers as well as a bank. Access to spending habits should tell them volumes about who we are and what support or products we may need. The hot house of intense competition looks set to create some of the most interesting innovation to date. What does this look like for a sector in flux?

Focus on people’s needs, not products

The wealth of customer data that banks hold is a treasure trove of useful marketing intelligence. Using that data to personalise your marketing and product offers can pay dividends, allowing you to predict and respond to individual needs as they evolve. Not only that, it allows banks to give their customers sound financial advice at the right moment, something an app would struggle to do.

The wealth of customer data that banks hold is a treasure trove of useful marketing intelligence. Using that data to personalise your marketing and product offers can pay dividends, allowing you to predict and respond to individual needs as they evolve. Not only that, it allows banks to give their customers sound financial advice at the right moment, something an app would struggle to do.

Westpac brings together data and communications from across the customer journey to create a single view that seamlessly integrates multi-channel customer interactions. Customers still want personalised one-to-one service from their bank, but this had become impossible for Westpac with one staff member to every 500-600 customers. Westpac created 'Symphony', a tool which brings together data, learns from behaviour and customer feedback, and creates targeted and more meaningful communications. All communications are connected across channels to create a seamless conversation, so customers don't have to re-start their discussion at each interaction, whether they're in branch, reading an email or banking online.

Optimise your customer journey

Banks must identify the moments that are most important to their varied customer base and build their customer experience to capitalise on them.  By removing moments of friction with a focus on simplicity, banks can optimise their customer journeys, delivering positive experiences that reinforce a coherent brand experience and leads to increased retention and acquisition through advocacy. Not only that, but a deeper understanding of those touchpoints will allow you to surprise and delight customers along the way. If banks are to become the chosen brand, they must understand that brand equity is only ever as good as the last experience, and it is the experiences that define brand perceptions.

By removing moments of friction with a focus on simplicity, banks can optimise their customer journeys, delivering positive experiences that reinforce a coherent brand experience and leads to increased retention and acquisition through advocacy. Not only that, but a deeper understanding of those touchpoints will allow you to surprise and delight customers along the way. If banks are to become the chosen brand, they must understand that brand equity is only ever as good as the last experience, and it is the experiences that define brand perceptions.

NatWest’s philosophy is simple: ‘We are what we do’. To live up to their ‘serving customers’ value, they developed a clever service in a simple and digital way to address the moment a wallet or card is lost. The NatWest app allows people to get cash from an ATM without their cash card, acting as a proof point to their promise and solving a real problem for their customers.

Define and live your purpose

Traditionally, banks were trusted partners, here to help us through life stages. Then, in 2008, came reform and recession. Many banks have since battled to rebuild trust, struggling to define themselves and what they stand for.  Defining their purpose is essential for brands seeking to carve out a niche in a competitive marketplace. In a world where most people think that businesses should have a purpose beyond accountability to their shareholders, this purpose will be vital for brand equity and creating positive moments with your customers.

Defining their purpose is essential for brands seeking to carve out a niche in a competitive marketplace. In a world where most people think that businesses should have a purpose beyond accountability to their shareholders, this purpose will be vital for brand equity and creating positive moments with your customers.  Banks must re-connect to consumers by understanding the moments that matter to them.

Banks must re-connect to consumers by understanding the moments that matter to them.

In South Africa, mobile and digital banking is a hygiene factor, as the market is technologically ten years ahead of the curve in the banking sector compared to other countries around the world. So here the challenge is quite different. Capitec came to market with a cheaper banking offer by attacking competitors who had high rates and fees. Their positioning ‘Simplified Banking’ was brought to life through their ‘Bank better to live better’ campaign showing how simple they make banking in people’s lives. Capitec has now surpassed some of the giant banks in South Africa to become the largest retail and consumer bank in the country.

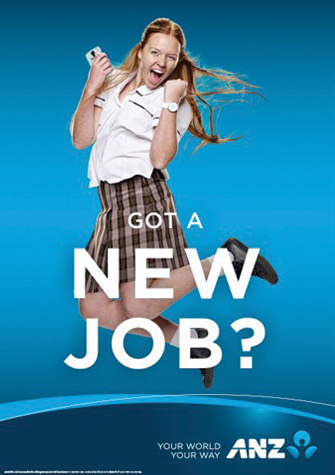

Research conducted by ANZ revealed that getting or changing jobs was one of the most significant triggers for opening up a bank account among 14-17 year-olds. ANZ became the bank for "your 'first real' job" by sharing stories that centred around 'that moment you find out you've got the job'. ANZ showed they understood the emotional significance of the ‘first job’ milestone and had the right product to help. Not only that, but they retrained front line staff to better deal with the needs of youngsters, converting them to long-term customers.

A whole new world for banking

As the world of banking digitises, there are more and more opportunities to create personalised moments with customers. Increasing competition will, no doubt, create some of the most interesting and innovative developments in the sector for many years. It will always be a balance between innovating too quickly, alienating traditional customers, or being too slow and being left behind. However, banks that embrace big data, optimise customer journeys and differentiate in ways that benefit their customers, whilst coherently delivering against their brand promise, will lead the way.