Marketing in the Social-Mobile world

Digital marketing strategies have historically had the web browser and the search engine at their heart. Marketers have relied on these channels to lead audiences to brand experiences on owned websites, to online video platforms where they can consume brand content, to eCommerce platforms where they can complete their purchases. And they have relied too on the data-driven opportunities for targeted advertising that these systems create. But as the battle for the next billion internet users heats up, the standard experience of the web that marketers are so comfortingly familiar with is likely to be turned on its head.

The end of the standard web experience

The end of the standard web experience

In many mobile-first markets, the web experience built around desktop PCs, browsers and search engines is not the norm. Already in large parts of Asia and Africa, social platforms are how people access the web, how they experience it, how they come to consider and complete purchases through it. Marketers in these regions must operate in a world where social and mobile aren’t just extensions of the web experience – they are the totality of the web experience. They must learn to think very differently: conceiving, planning and executing strategies for a Social-Mobile world.

How social is becoming the gateway to the internet

When we look in detail at Asia, we see that social media is the fastest growing digital activity in the region (activity on social networks is up 10% year-on-year and instant messaging (IM) activity is rising even faster at 13%) and this increase is in part driven by new users to the internet.  Social-Mobile is the forward momentum for internet penetration – and those accessing the internet for the first time through smartphones tend to do so through the dominant IM and social media platforms for their market: apps like WeChat, KakaoTalk, LINE, Instagram, Facebook, Snapchat and WhatsApp. As the scope of those apps increases, providing access to content, customer service and buying opportunities, there’s minimal need to seek out internet experiences beyond these walled gardens – and beyond a mobile phone screen. Why would someone with a trusted IM app on their phone go out of their way to research and buy products through the traditional web instead – and why would any smart marketer require them to?

Social-Mobile is the forward momentum for internet penetration – and those accessing the internet for the first time through smartphones tend to do so through the dominant IM and social media platforms for their market: apps like WeChat, KakaoTalk, LINE, Instagram, Facebook, Snapchat and WhatsApp. As the scope of those apps increases, providing access to content, customer service and buying opportunities, there’s minimal need to seek out internet experiences beyond these walled gardens – and beyond a mobile phone screen. Why would someone with a trusted IM app on their phone go out of their way to research and buy products through the traditional web instead – and why would any smart marketer require them to?

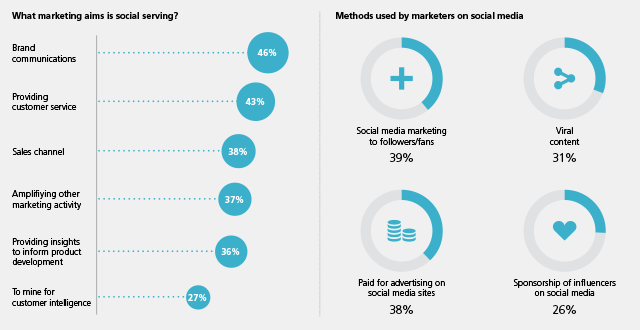

In Marketing Monitor – our study of the priorities and challenges of marketers in Asia Pacific - we can see how social media now dominates every aspect of brands’ management of customer journeys, as marketers respond to the fact that the majority of their audiences’ digital lives are lived out on social platforms.  Social media is the most frequent choice for building brand awareness, with marketers more likely to use paid-for social media ads (38%) than they are TV advertising (35%). It is also the most frequently used touchpoint within eCommerce strategies (used by 47% of marketers) and the single most important channel for customer service, with 46% of marketers providing customer service through social, and 33% using IM platforms specifically.

Social media is the most frequent choice for building brand awareness, with marketers more likely to use paid-for social media ads (38%) than they are TV advertising (35%). It is also the most frequently used touchpoint within eCommerce strategies (used by 47% of marketers) and the single most important channel for customer service, with 46% of marketers providing customer service through social, and 33% using IM platforms specifically.

Similar developments are quickly coming to more mature Western markets – the last strongholds of the desktop PC and web browser. Facebook has long been mobile-first and with such a significant user base, more people are able to access a more complete web experience without leaving the confines of the social network. The introduction of AI-driven chat bots to Facebook Messenger makes it well-placed to play a role as an eCommerce and customer service platform, whilst Facebook Instant Articles are making sought-after content readily available in mobile-friendly social streams.

Marketers seeking to negotiate the Social-Mobile world that is set to emerge in developed markets will benefit a great deal from watching their peers in Asia – and the challenges they are currently facing.

In need of a deeper strategy for social

The greatest of these challenges involves the need for deeper insight to help brands negotiate an increasingly complex and fragmented social landscape. That complexity stems both from the range of different platforms that people use – and the different functions that they fulfill through them.

Today, smartphone screens in Asia are likely to have at least five different social and IM apps on them as regional social networks expand to new markets and compete with global alternatives from Viber to Facebook Messenger and BlackBerry Messenger (still dominant in Indonesia).

That’s just the start of the complexity, however: as social and IM platforms have competed, they’ve added new offers, services and functionality, enabling their users and the marketers seeking to reach them to do far more. The major IM platforms in Asia are already content distribution networks, gaming platforms, mobile payment tools and sales channels.

To succeed, marketers must understand the different, nuanced roles that these platforms play in the lives of their audiences: which are the intimate environments reserved for interactions with friends and family? Which are the broader marketplaces where people might be actively seeking out content, experiences – and buying opportunities? It’s not enough to know how many followers, shares and interactions they generate on Facebook Messenger versus LINE versus WeChat, for example; they need to know what these numbers mean in the context of their ultimate brand objectives: engaging the right people through the right touchpoints, in order to drive incremental sales and growth.

The difference between social data and social insight

One of the most interesting findings to emerge from this year’s Marketing Monitor survey is the tensions and frustrations that adapting to a Social-Mobile world creates for marketers.  Social media monitoring is now the most commonly used measure of brand performance, ahead of sales, market share and brand and ad tracking – but is it delivering the full picture that marketers need?

Social media monitoring is now the most commonly used measure of brand performance, ahead of sales, market share and brand and ad tracking – but is it delivering the full picture that marketers need?

Social media really fulfils its potential to provide insights to marketers when it is placed in context. For example, a brand measuring the social conversation that is happening related to their campaign, which empowers them to course correct whilst the campaign is still live.

To extract the insights that matter, brands need to go beyond a basic analysis of social and marry the data with other metrics, e.g. drivers of a positive or negative customer experience, or brand equity attributes. By doing this, we can build a much richer picture of why our brands are performing the way that they are. Social media in isolation does provide an early warning system for issues that may have a longer-term impact on brand performance, but without accessing other sources, this data is limited.

Generating a fuller understanding isn’t easy though, and the problem is often a structural one, with teams operating in isolation. For example, despite the fact that customer relationship management is marketers’ top priority in Asia, fewer than half say that they are actually collaborating with their customer service teams. Only 39% work with business development, whilst only a third are collaborating with sales and even fewer are working with the specialist digital team. The inevitable result of these internal siloes is that marketers rarely get to see the social media activity in its full, relevant context. When you don’t know what social metrics mean in terms of customer experience and loyalty or brand equity and sales, you cannot validate your decisions based on this data alone.

Generating a fuller understanding isn’t easy though, and the problem is often a structural one, with teams operating in isolation. For example, despite the fact that customer relationship management is marketers’ top priority in Asia, fewer than half say that they are actually collaborating with their customer service teams. Only 39% work with business development, whilst only a third are collaborating with sales and even fewer are working with the specialist digital team. The inevitable result of these internal siloes is that marketers rarely get to see the social media activity in its full, relevant context. When you don’t know what social metrics mean in terms of customer experience and loyalty or brand equity and sales, you cannot validate your decisions based on this data alone.

A third of marketers in Asia describe social media analytics as a priority area for development going forward – and they are right. Marketers in all regions will need real-time data that can keep them in touch with the voice of the customer – but they also need a real understanding of what that data means in terms of brand and business objectives. This demands research-led models that can explore the relationship of social media sentiment, engagement and behaviour to brand equity, sales and revenue. Putting social media listening data into a fuller context will go a long way towards helping marketers build more meaningful strategies for the Social-Mobile world.

Zoë is responsible for the success of TNS’s suite of digital products across Asia Pacific – leveraging social, mobile and behavioural data to help clients better engage with their connected consumers. Zoë has been with TNS since 2010, and has held a number of different roles, initially in global marketing and since 2014 in the APAC region.