We live in an ‘on-demand’ economy, with goods and services designed to arrive at lightning speed for virtually all of life’s moments. That moment you need a taxi? An Uber is 2 minutes away. Hungry right now? Deliveroo will bring your favourite meal to your door in under an hour. Need to pay an overdue bill? Do it via your bank’s smartphone app on your commute.

We want things now, and we’re used to getting our way. This desire for instant gratification is even hard wired into our psyche, psychologists call it ‘future discounting’. We simply value things that gratify us in the short term over those that deliver value in the long term (ask any smoker, or after work drinker if you don’t believe us).

What does this mean then, for a product such as insurance? A product with an intangible and indefinite benefit? For years, the insurance market relied on complex products sold through instilling a sense of fear about the future. Couple this with low consumer engagement rates and a traditionally slow rate of innovation and you have a product category ripe for disruption.

In a world that’s truly on-demand, changing by the second, and where people live in the moment (not in the future), insurance brands in particular must adapt quicker than ever to stay relevant. Doom and gloom stories are the traditional marketing tactic to sell insurance plans for a reason: they’re designed to elicit an emotional response (fear). But fear led purchases don’t always foster brand loyalty. Insurers need to go beyond using fear and think about how to build deeper, emotional relationships with customers. Fear can be resolved emotionally in a number of ways and insurers should consider how to tap into the right emotion in their communications.

So how can such a daunting product become less fearful and more relevant to their customer’s daily lives, useful, and even aspirational?

Focus on today, not the future

Insurance brands are starting to find moments that help customers today rather than to protect against future misfortune.

Manulife in Hong Kong flipped traditional insurance selling on its head to appeal to younger people by helping them to live healthier lifestyles. Providing a wearable device to encourage people to move more and be more active, Manulife offers rewards oriented around those with the most active lifestyles. They’ve driven growth in customer loyalty by taking an active interest in improving their customer’s well-being and reaching out to a younger audience who are typically not too concerned with insurance products.

Manulife Move playfully promotes fitness benefits in a youthful and lively campaign that brings to life the benefit of being fit and healthy today, not tomorrow...

Today, as our technology devices begin to seamlessly integrate into daily tasks, insurance brands have a unique opportunity to use in the moment data to predict and even prevent future life scenarios. Providing customers with a fitness tracker gives the insurer valuable data to help them offer lower premiums to people who keep the most active. This motivates customers to stay more healthy and also means less pay-outs for the insurer in the long run, a win-win.

Be ‘On-Demand’

Advancements in technology are creating a plethora of new product opportunities. Leading the market with on-demand products could give the competitive edge that comes with giving people the option to make convenient, in the moment purchases. Those already leading the way include:

Cuvva discovered a moment that was still underserved in the insurance market: when you need to borrow a friend’s car for an hour and their insurance plan doesn’t cover you. Or, you own a car but just need it for surf trips on weekends. Cuvva offers flexible car insurance products within a market that traditionally only operates under strict annual policies. They recognised a potential moment of tension in the customer journey when customers have to call the insurer to adjust the policy. They addressed this by developing an app that enables their customers to adjust the policy instantly.

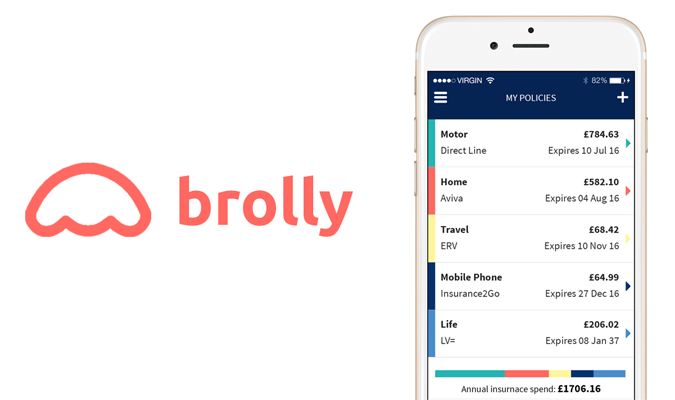

The moment of researching and buying insurance for your life, car or house can be loaded with tension. Brolly is a new “personal insurance concierge”, designed to cater to the complex and arduous process of product purchase or renewal. Powered by AI, Brolly is built to meet customers’ varying insurance needs and help simplify them at the moment of purchase, resulting in a hassle-free experience.

Show your brand in action

Insurance companies exist for those superhero moments, right? When life goes wrong, an insurance plan’s purpose - to save the day - is realised and helps dissolve a stressful emergency. But people tend to avoid thinking about the worst case scenario, or do not consider that the worst could happen to them personally. This means that insurance brands are not often top of their customer’s mind unless they need to make a claim.

To reinvigorate customer loyalty and increase falling market share, Direct Line focused on the moment when something actually does go wrong and produced an imaginative video series starring Pulp Fiction’s Harvey Keitel positioning the brand as a heroic “fixer” of life emergencies. They even incorporated a twitter campaign with real-life “fixers” to find and help people in actual emergencies. Showing off the benefits using case-by-case scenarios meant they could also highlight specific elements of their premium cover products and show them working in action.

In choosing to ‘hook’ their customers by arousing imagination with real life scenarios and not just the usual price and cover differentiation, Direct Line connected with their customers on an emotional level and increased their market share in a fiercely competitive market.

We live in the moment: so must our insurance

New technology and fast moving lifestyles mean we now need easier ways for insurance to help us prepare for, predict and prevent life’s uncertainties. Though these uncertainties historically activate the benefits of an insurance product, the changing market means insurers are now uniquely positioned to create new products that find and connect with many moments in their customer’s daily lives.

Connecting consumers with the long and short term benefits of an insurance product, and expanding services so that they are relevant and visceral (relate to the “now” moment) will help increase brand visibility, trust and loyalty and help to retain customers’ longer term.